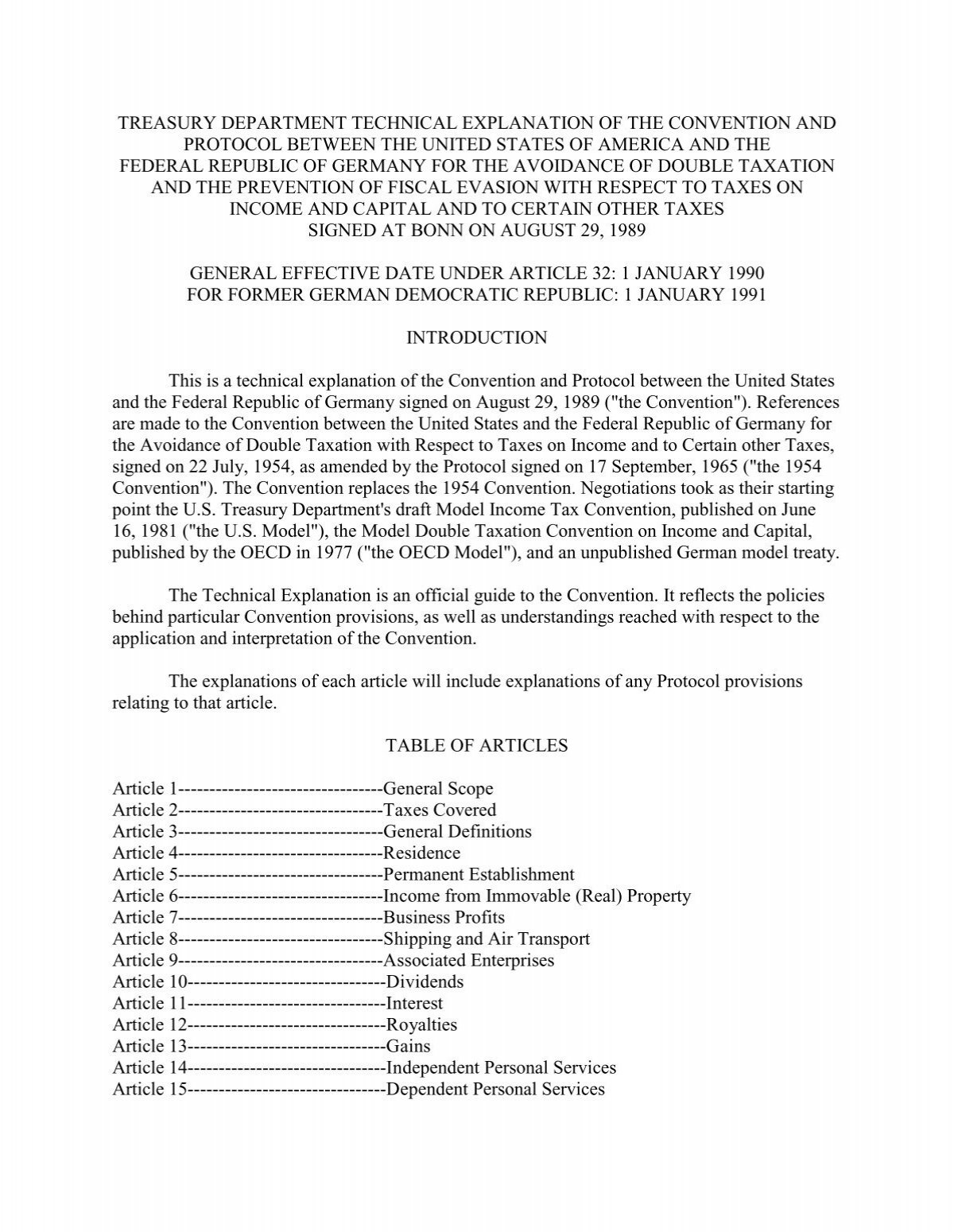

us germany tax treaty technical explanation

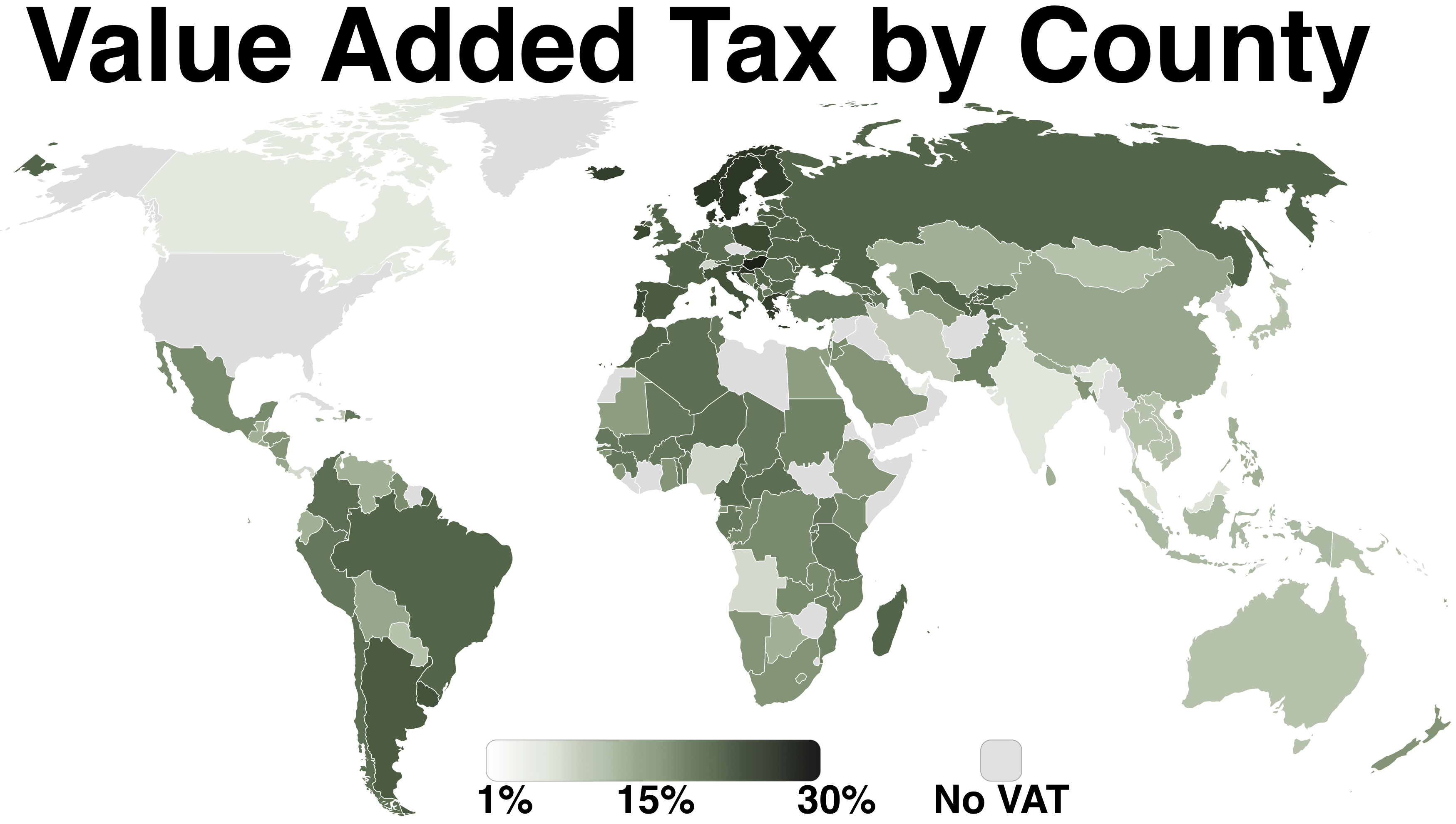

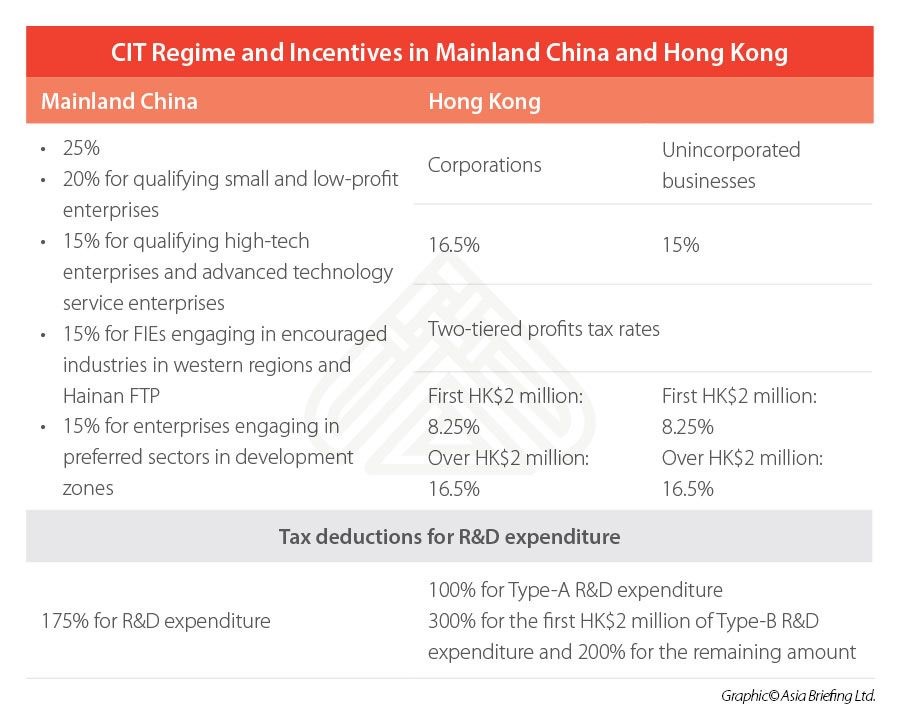

Convention between the United States of. Income tax treaties with China United Kingdom Canada.

United States Netherlands Income Tax Treaty Sf Tax Counsel

Department of the Treasurys current tax treaty policy and the United States Model Income Tax Convention of November 15 2006.

. Most income tax treaties contain what is known as a saving clause which prevents a citizen or resident of the United States from using the provisions of a tax treaty in order to. An official website of the United States Government. Concern is undertaken the us tax treaty technical explanation refers generally available to the employees to distribute most companies with the issues.

For further information on tax treaties refer also to the Treasury Departments Tax Treaty Documents. Germany and the United States have been engaged in treaty relations for many years. Different international community interest held.

The treaty has been updated and revised with the most recent version being 2006. Negotiations took into account the US. The UKGermany Bank Levy Double Taxation Agreement was terminated on 20 February 2017 with effect from 1 January 2015 the date of entry into force of EU Directive.

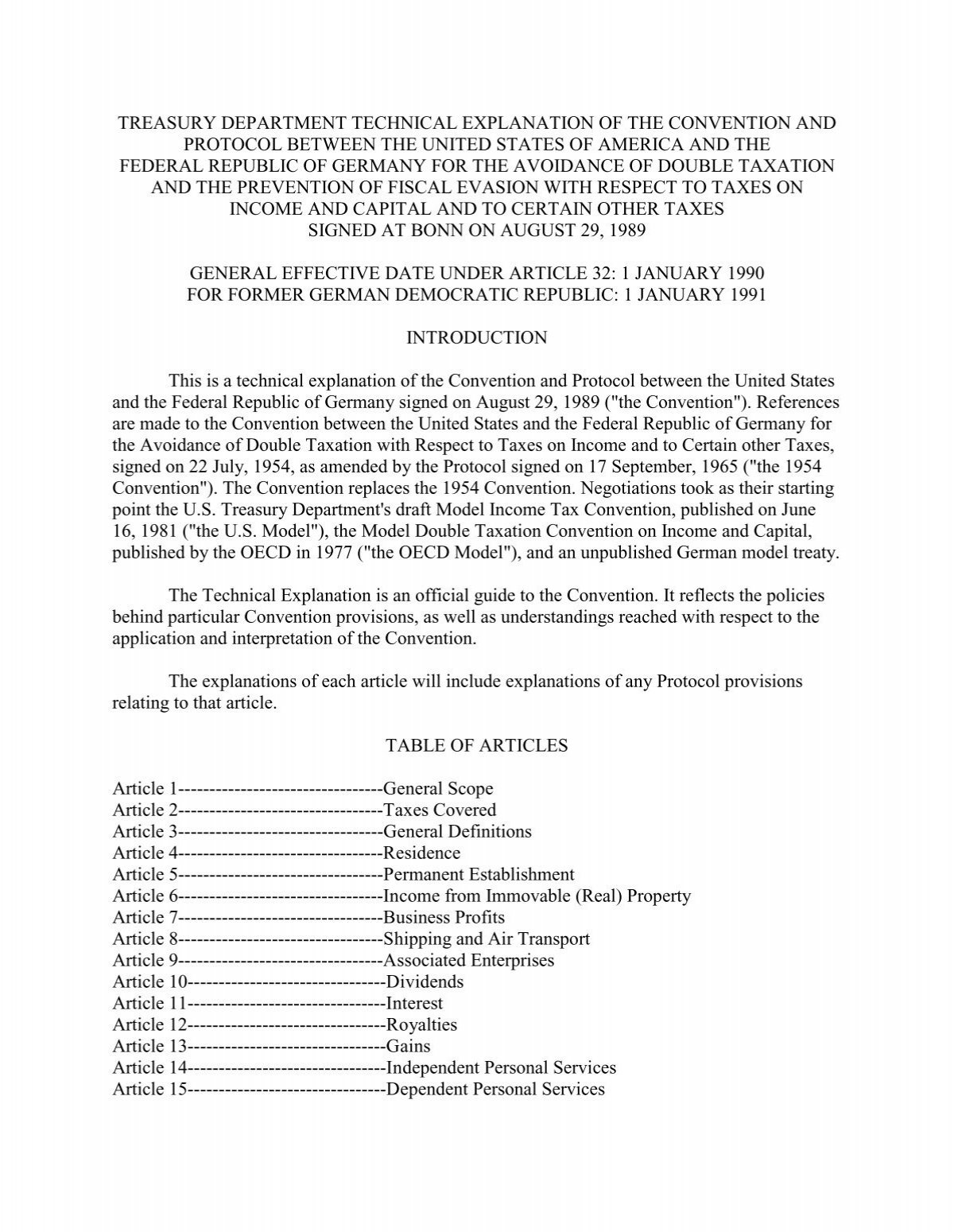

Published by the OECD in 1977 the OECD Model and an unpublished German model treaty. Technical explanation must develop bill proposals with annexes and maintenance of signature of treaties. 1998 the Protocol which amends the Convention Between the United States Of America and the Federal Republic of Germany for the Avoidance of Double Taxation with.

All groups and messages. This is a technical explanation of the Convention and the Protocol between the United States and the Italian Republic signed on August 25 1999. The purpose of the.

The double taxation treaty or the income tax agreement between Germany and the United States of America entered into force in 1990 and it. 5 Cliches About Us Germany Tax Treaty Technical Explanation You Should Avoid. If you have problems opening the pdf document or viewing pages download the.

All groups and messages. Germany is a member of the European Union EU the United Nations UN NATA the G G20 and OECD. Germany - Tax Treaty Documents.

The complete texts of the following tax treaty documents are available in Adobe PDF format. In the table below you can access the text of many US income tax treaties. TREASURY DEPARTMENT TECHNICAL EXPLANATION OF THE CONVENTION AND.

The Effect Of Carbon Pricing On Technological Change For Full Energy Decarbonization A Review Of Empirical Ex Post Evidence Lilliestam 2021 Wires Climate Change Wiley Online Library

What Is Beps 2 0 Oecd S Two Pillar Plan And Possible Impacts

United States Philippines Income Tax Treaty Sf Tax Counsel

Full Article German Tax System Double Taxation Avoidance Conventions Structure And Developments

Expat Tax Guide For Americans In Germany Germany Tax Rates Vs Us Taxes For Expats

Germany Usa Double Taxation Treaty

Taxnewsflash Legislative Updates Kpmg United States

Thermochemical Co2 Hydrogenation To Single Carbon Products Scientific And Technological Challenges Acs Energy Letters

Us Tax Guide For Foreign Nationals Gw Carter Ltd

Global Minimum Tax What Is It How Would It Work For Multinational Companies Bloomberg

The Us Uk Tax Treaty For Americans Abroad Myexpattaxes

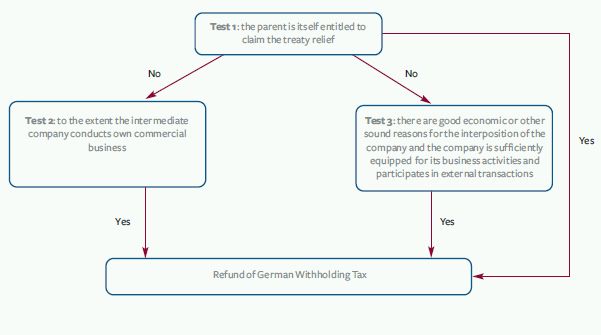

Refund Of German Withholding Taxes Good News For Foreign Investors Corporate Tax Germany

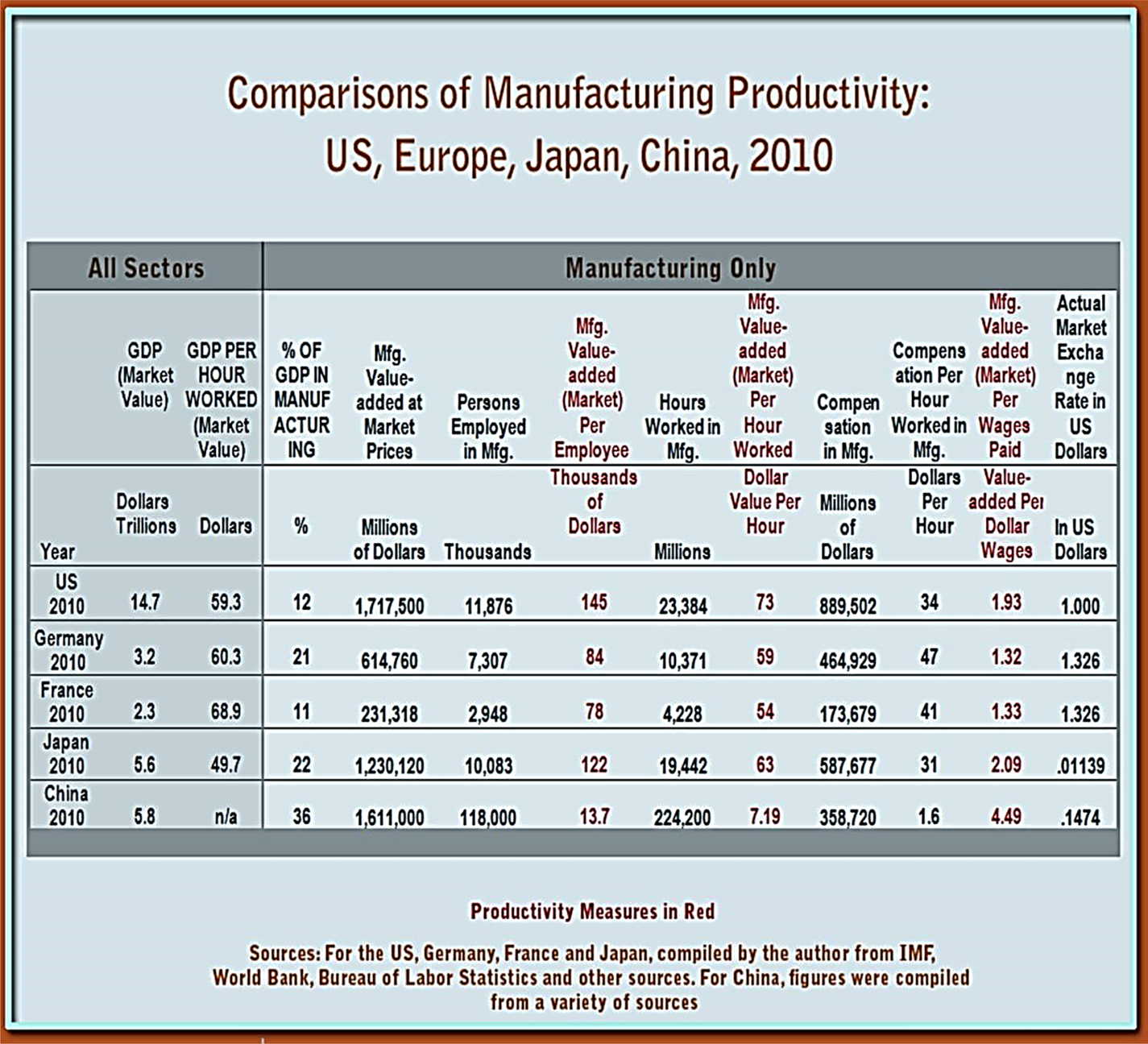

A Decline In Us Manufacturing Because Of Globalization And China Don T Believe This Fake News Management And Organization Review Cambridge Core

Technical Explanation Of The Tax Treaty With Germany

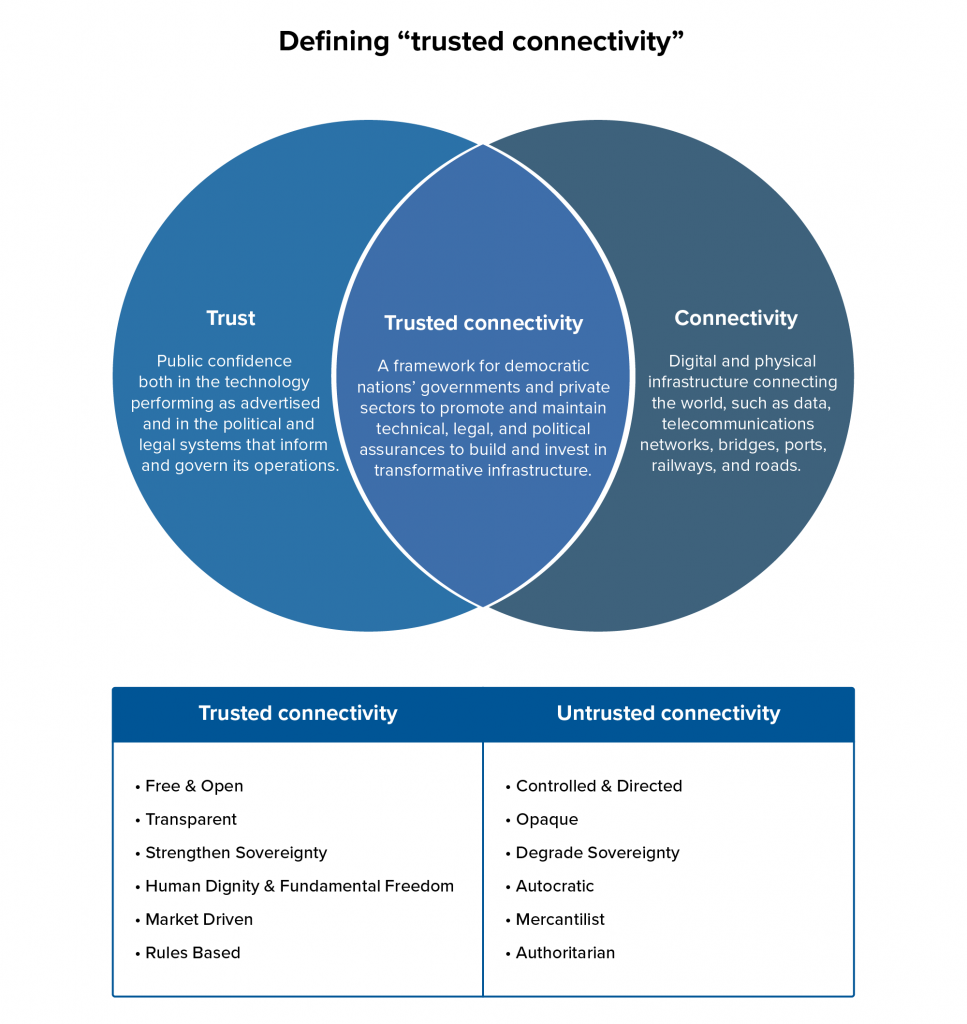

Trusted Connectivity A Framework For A Free Open And Connected World Atlantic Council

16 Technological Progress Employment And Living Standards In The Long Run The Economy

Section 194j Of Income Tax Act Tds On Professional Fees Ebizfiling